Have you been offered a free financial literacy program from a credit union or bank? Credibility and conflicts of interest are issues that must be considered before accepting these tempting offers. This report from The American Banker, shows that 13 of 17 top benefits of free financial education programs go to the financial institution, not students. We all love free stuff, these programs may not be instill in your students an appropriate level of skepticism of banks and other lenders.

Our resources meet and exceed the National Standards for FInancial Literacy! Download our alignment chart — make notes on your state’s standards.

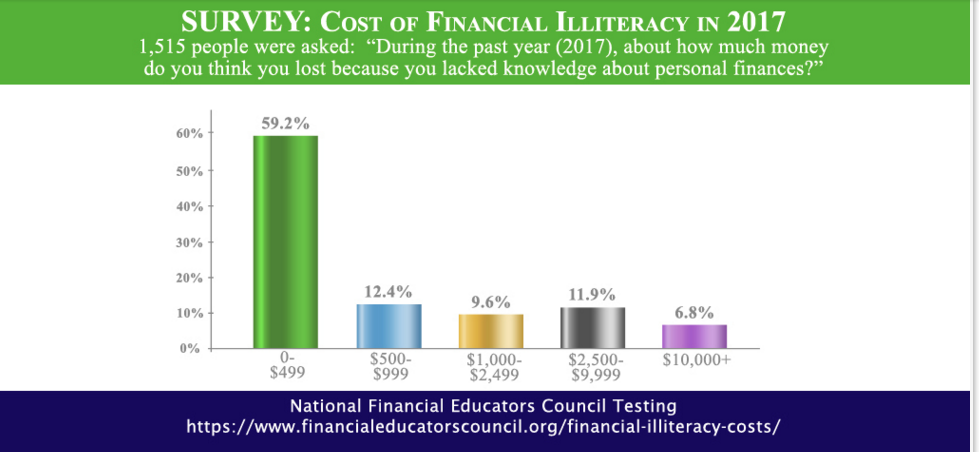

In a recent survey conducted by the National Financial Educator’s Council U.S. residents were asked, “During the past year (2017), about how much money do you think you lost because you lacked knowledge about personal finances?” A total of 1,515 participated in the survey, representing six age groups across the country. Respondents estimated that lacking knowledge about personal finances cost them an average of $1,171 in 2017. Wow.

10 Guidelines (and a Rubric!) for Evaluating FInancial Literacy Curriculum. As financial education gains ground around the country, principals and administrators are faced with the task of either designing a program for their students or selecting a commercially available one. How can you separate a good financial education curriculum from a not-so-good one? Here are ten guidelines to help you evaluate a financial education program to decide whether it’s right for your students.

What’s the federal government’s take on the value of financial literacy education in the U.S.? No less than 23 councils and committees (your tax dollars at work!) have joined forces to establish a National Strategy for Financial Education. One thing they all agree on is that starting early with financial literacy programs and practices is key to success.

According to Price Waterhouse Cooper, 92 percent of K-12 teachers surveyed by the Financial Literacy Education Council said they believed financial education should be taught in school. The same survey revealed the two primary reasons why teachers are reluctant to teach personal finance and money management: they lack competency and curriculum. c21’s mission is to provide the reluctant financial educator with both. Our Teach the Teach podcasts are introduced and explained in this May 2017 press release.

The Council for Economic Education (CEE) comprehensively reviews the state of K-12 economic and financial education in the United States, collecting data from all 50 states and the District of Columbia. The biennial Survey of the States shows how far we’ve come and how far we still have to go to become a financially literate nation.

Blinded by love, most couples head down the aisle having had zero discussion about how they’ll handle money. That’s pretty crazy considering that, according to experts, the third most common reason for divorce in the U.S. is money issues. Students pair up as faux fiancees to compare money goals and management skills. Are they match made in financial heaven, or will their lack of financial compatibility be a deal breaker?

When your students complete The 21st Century Student’s Guide to Financial Literacy – Getting Personal acknowledge their accomplishments with this downloadable pdf Certificate of Achievement that can be personalize for each student.

Need evidence supporting your efforts to provide a financial literacy course to your students? In 2015, our friends at FLEC asked the Journal of Consumer Affairs to dedicate a special issue to financial literacy research focusing on “Starting Early for Financial Success.” The result was ten academic research papers written by economists and educators who explain why early financial education is so important to the future financial security of our nation’s children.

What’s behind the Trait to Innovate? Almost none of the products we use, medicines we take, or appliances we rely on to make our lives easier, safer, or more enjoyable are in their original form. Over time, they have been revised and reworked to be better in some or many ways, and to meet the changing needs of society. Innovators and entrepreneurs are at the heart of these changes! What kind of person is a successful entrepreneur? What traits make a person willing to “risk it all” for success?

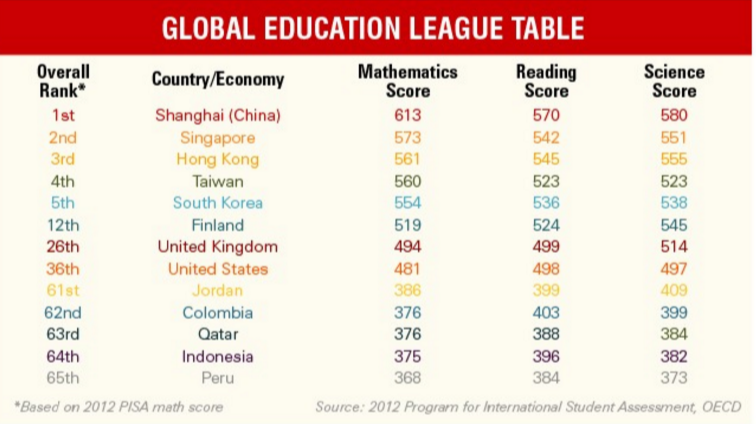

Download only U.S. Students’ Results

PISA 2016 Results – Students’ Financial Literacy survey explores students’ experience with and knowledge about money. Other than being masters at wasting their parents’ cash, American teens don’t know much about money. Their score falls below the international average, just below Latvia and Poland.

According to the Champlain College Center for Financial Literacy report card, 26 states received grades of C, D or F for personal finance education in 2017. How did your state do? Let’s make a nationwide effort to bring our grades up!

For better or worse, the National Standards for FInancial Literacy provide a framework for teaching personal finance in kindergarten through 12th grade.

Check out the August/September 2017 issue of The Financial Literacy Teacher if you’re considering offering a personal finance course in your school or district. Ten Guidelines for Evaluating a Financial Literacy Program can help you decide whether a curriculum is right for your students. Learn how to separate a good financial education program from a not-so-good one, and essentials for designing your own course.

What do your students know about wealth disparity in America? It’s an important political and economic issue. Here’s a worksheet for teaching about the basics and language of wealth disparity. It was created for a St. Patrick’s Day activity, but works year round!

A lot has been said about financial education. Here’s a collection of quotes from experts who know what they’re talking about!

“Teaching personal finance is not about describing financial products, it is about teaching the principles of financial decision-making so that people understand how financial instruments work.” Annamaria Lusardi,Denit Trust chair of economics and accountancy at the George Washington University School of Business. See more

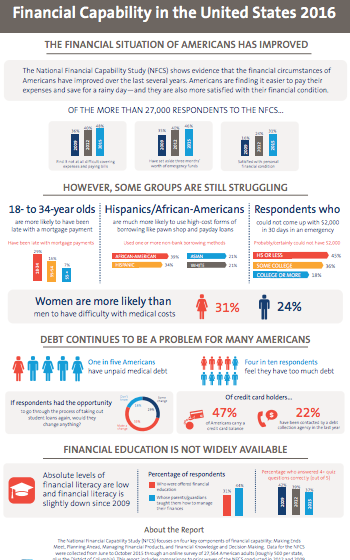

The FINRA Investor Education Foundation tells us that the financial landscape in the U.S. continues to go through rapid changes as more and more responsibility falls to consumers to manage their financial well-being. How are we doing as a nation? Not very well.

Check out the Dec 2017/Jan 2018 issue of The Financial Literacy Teacher for 7 Gifts That Keep Giving — a list of our favorite digital tools and resources that will help your students develop and maintain good personal finance habits and behaviors for life!